|

0 Comments

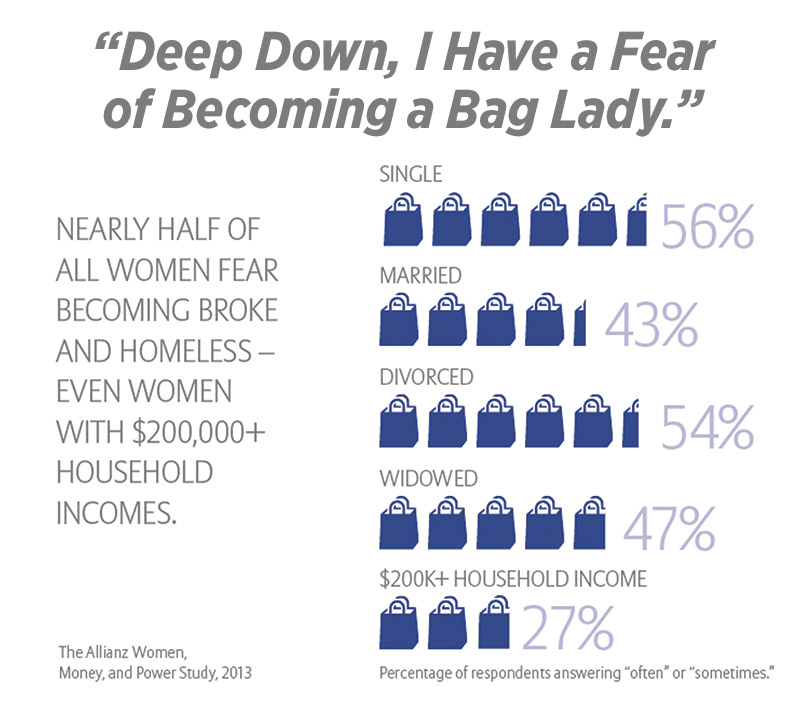

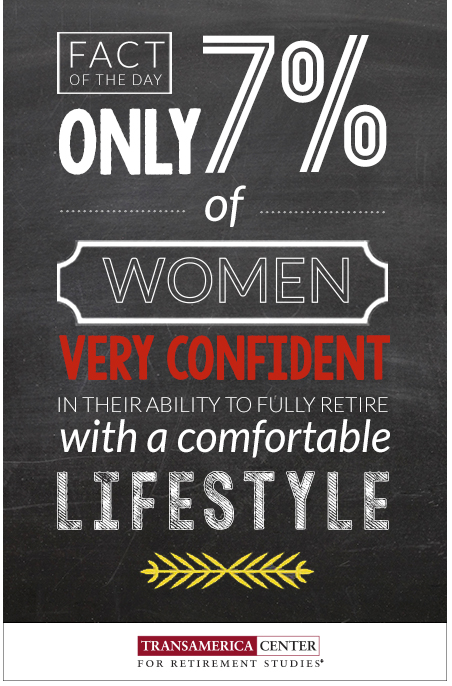

According to some of the findings from the 15th Annual Transamerica Retirement Survey of Workers, women are still at a greater risk of not being financially secure for retirement. These 10 facts are meant to inform women about the retirement risks that they face:

There is hope! There are small steps that women (and men) can take that lead to a more secure and lasting retirement. How each woman plans on spending her retirement years is going to be different and unique to each, but the basic tools to help achieve financial security are common to everyone. Seven specific steps that women can take to improve their retirement readiness include:

When "building a financial future", I have a simple philosophy: Protect today against the unexpected while you prepare for a tomorrow that provides financial security and piece of mind.

In addition to the many financial solutions I offer, I also provide connections to other successful professionals in the area such as Attorneys, CPA's, and others to help you protect today and plan for tomorrow. The Little Cow - Unkown AuthorA master of Wisdom was walking through the countryside with his apprentice when they came to a small, disheveled shack on a meager piece of farmland. "See this poor family," said the Master, "Go see if they will share with us their food." "But we have plenty," said the apprentice. The master said, "Do as I say." The obedient apprentice went to the home. The good farmer and his wife, surrounded by their seven children, came to the door. Their clothes were dirty and in tatters. "Fair greetings," said the apprentice, "My Master and I are sojourners and want for food. I've come to see if you have any to share." The farmer said, "We have little, but what we have we will share." He walked away, and then returned with a small piece of cheese and a crust of bread. "I am sorry, but we don't have much." The apprentice did not want to take their food but did as he had been instructed. "Thank you. Your sacrifice is great." "Life is difficult," the farmer said, "but we get by. And in spite of our poverty, we do have one great blessing." "What blessing is that?" asked the apprentice. "We have a little cow. She provides us milk and cheese, which we eat or sell in the marketplace. It is not much but she provides enough for us to live on." The apprentice went back to his Master with the meager rations and reported what he had learned about the farmer’s plight. The Master of Wisdom said, "I am pleased to hear of their generosity, but I am greatly sorrowed by their circumstance. Before we leave this place, I have one more task for you.” "Speak, Master." "Return to the shack and bring back their cow." The apprentice did not know why, but he knew his Master to be merciful and wise, so he did as he was told. When he returned with the cow, he said to his Master, "I have done as you commanded. Now what is it that you would do with this cow?" "See yonder cliffs? Take the cow to the highest crest and push her over." The apprentice was stunned. "But Master..." "Do as I say." The apprentice sorrowfully obeyed. When he had completed his task, the Master and his apprentice went on their way. Over the next years, the apprentice grew in mercy and wisdom. But every time he thought back on the visit to the poor farmer's family, he felt a pang of guilt. One day he decided to go back to the farmer and apologize for what he had done. But when he arrived at the farm, the small shack was gone. Instead there was a large, fenced villa. "Oh no," he cried, "The poor family who was here was driven out by my evil deed." Determined to learn what had become of the family, he went to the villa and pounded on its great door. A servant answered the door. "I would like to speak to the master of the house," the apprentice said. "As you wish," said the servant. A moment later a smiling, well-dressed man greeted the apprentice. "How may I serve you?" the wealthy man asked. "Pardon me, Sir, but could you tell me what has become of the family who once lived on this land but is no more?" "I do not know what you speak of," the man replied, "my family has lived on this land for three generations." The apprentice looked at him quizzically. "Many years ago I walked through this valley, where I met a farmer and his seven children. But they were very poor and lived in a small shack." "Oh," the man said smiling, "that was my family. But my children have all grown now and have their own estates." The apprentice was astonished. "But you are no longer poor. What happened?" "God works in mysterious ways," the man said, smiling. "We had this little cow that provided us with the slimmest of necessities, enough to survive but little more. We suffered but expected no more from life. Then, one day, our little cow wandered off and fell over a cliff. We knew that we would be ruined without her, so we did everything we could to survive. Only then did we discover that we had greater power and abilities than we possibly imagined and never would have found as long as we relied on that cow. What a great blessing from Heaven to have lost our little cow.” I think we all have a "little cow" in our life holding us back. We often forget what it is like to dream of a brighter tomorrow. We settle, and sometimes suffer, and expect no more from life.

However, the next time that one of your "little cows" is taken away, take the opportunity to grow and learn and accomplish more. You never know what potential you have to make the world a better place until you let everything go and give it your all. Many mothers, my wife included, are constantly faced with decisions about spending money on the kids, which can sometimes be overwhelming. With that in mind, here are a few ideas to help busy money-conscious moms stay on budget without starving the kids. 1) Buy Used. Clothes, clothes and more clothes. If you have three kids like my wife and I do, or even if you only have one, clothes can be expensive. However, there are many "gently used" clothing stores can do wonders for your budget while still keeping your kids in style. My favorites are Plato's Closet, Kid to Kid, and Once Upon a Child. Don't forget that your local Goodwill or similar store can also hold many hidden treasures! 2) They will eat you out of house and home. Have you ever felt like the refrigerator or your pantry have holes in the bottom where all of the food goes? Unless you really DO have holes where you store your food, this phenomenon can probably be explained by your children's crusade to consume everything in sight. Your grocery bill is often one of the biggest expenses in your household budget. You can start cutting back by remembering a few tips. First, when grocery shopping, buy more ingredients vs. pre-packaged meals and try to prepare most of your meals at home. Keeping meal costs to $5 per-person per-meal (or less) is a good starting point. Rarely will eating out be so inexpensive. Second, if you can, grow as much of your food at home. If you live in the city, you can actually grow food in your windows, Britt Riley shares about growing food in urban areas. 3) Next, use coupons when you can and of course, buy in bulk. Many stores like Sams Club or Costco will allow you to get the biggest bang for your buck and ultimately save you money. A good friend of mine also recently reminded me about group coupon services like Groupon. 4) Inexpensive or free trips. Most of us live within a few miles from the great outdoors or a park. These make great places to take your kids! Playgrounds are a plus of course, but taking a hike or walking along a lake are always fun. Remember, kids want to spend time with you. Urban areas will also have museums or libraries that can offer a day of fun for little money. 5) Hire your friends (for free). Taking care of your children 24/7 can be exhausting. Your body and mind seem to reach their breaking point and beyond. Remember the phrase "it takes a village to raise a child"? Why not share your parenting responsibilities with your friends? Exchange baby-sitting nights with your friends that have children. You can get needed time off to rest/relax or get the house chores completed (again). Also, carpooling and arranging to pick-up and drop-off kids as a group can cut down on fuel bills and time. 6) Plan ahead. If you have a number of errands to run, it helps to plan your trip beforehand. Map out your route so you aren't wasting time and gas driving haphazardly around town. It can also make a difference when you plan your trips around your children's activities. When my daughter was in ballet rehearsal for an hour, I found it was a fantastic time to get some quick errands done and make it back in time to pick her up. 7) Remember reading? Books are becoming a lost memory for many parents. All too often we resort to the "electronic babysitter" to entertain our children .However, instead of renting a movie or video game (believe me, these costs add up quickly), find a book appropriate for your child and read it to them. If they're old enough, you can even have them read it to you! This can be a very inexpensive way to entertain even the "attention challenged" child. Being a Mom can be the most challenging and rewarding job there is. Using these cost-effective ideas can help you focus more on your kids, and not how much money they're costing you. Have any tips or ideas of your own? Please share in the comments below!

In my line of work, I speak with a lot of people about THEIR health. Among other things, the occurrence of high blood pressure seems to be as common as getting a cold. I don't know the exact numbers, but it occurs to me that there are A LOT of people who are not as healthy as they could be. And like myself, many of them are unhealthy because they are not willing to change the lifestyle to which they have become accustomed. Instead, we take a pill, and consider the problem managed... for now. But eventually, it all catches up to us and we must face our worst fears. A stern lecture from our doctor, heart attack, stroke, or worse is usually what it takes to get us to change our actions...

Ganoderma is available in capsules and liquid extracts, both of which can be found at most health food stores. However, as Eyvette was happily shared with me is that it can be found in COFFEE (also some teas and hot chocolate). Something that so many of us take for granted as just a part of our normal morning routine could improve our health. Eyvette was recently able to lower her blood pressure and stop taking medication as a result of drinking coffee with Ganoderma in it. So at this point, I'm going to make a change. My daily soda in the morning will be replaced with coffee, and I'll keep track of my weight and blood pressure. I'll keep a log of how I'm feeling and how much energy I have, and "we'll see".

Centers for disease control and prevention. (2010, July 21). Heart disease and stroke prevention: Addressing the nation's leading killers. Retrieved from http://www.cdc.gov/chronicdisease/resources/publications/AAG/dhdsp.htm

For those of you who are not familiar with Tom Hegna, he is an economist, author, and retirement expert! He is considered one of the elite of the financial industry. I ran across these videos this morning and could not avoid sharing them with you all. Check it out!

Building a secure and lasting financial future is possible. It will take smart planning, and a strong commitment, but the future is bright for those who start, and it's never "too late."

Feel free to comment below or contact me with questions or for more information about building a better tomorrow. To grasp the concept of diversification, it helps to know about asset allocation. In simple terms, this is how your money is placed into three main types of savings and investment vehicles: stocks, bonds, and cash. Asset allocation is often shown in the form of percentages. For example, someone may have a retirement portfolio that is 20% stocks, 60% bonds, and 20% cash. It's important to note that how you allocate your retirement savings can be one of the most important factors in creating a secure retirement. Sometimes more important than how much you save. Take the story at the beginning of this post for example. My client says that he had plenty of money saved for retirement, but his big mistake was not understanding the allocation of his portfolio. Many experts and Financial Professionals suggest that you keep in mind all three types of savings and investments. Keeping your money in cash usually has the lowest amount of associated risk, but also returns the least reward or gain. Stocks, many times, have the greatest potential for gains, but also many times they have the greatest potential for loss, and therefore risk. How you chose to diversify your savings and investments should be based mostly on two things: Timing- When do you want to retire? -and- Risk tolerance- With how much risk are you comfortable? Generally, the closer you are to retirement, your tolerance for risk is usually a lot lower. Why? Because you will have less time to save and invest your money, and, like in my example above, if you lose much of your retirement money, you may not have time to recover your losses. Every so often you should think about your changing risk tolerance with regards to when you wish to retire. Usually, as time goes on, people tend to move their assets into more secure and conservative programs. Diversification, to reduce risk, is very important to having a healthy nest egg. If you have any further questions about what it is and how it works, contact your personal Financial Professional or use the buttons below for more information and to contact me for a free no-obligation conversation about your goals and dreams. Does this sound familiar? Unfortunately, my client wasn't the only one affected by the turbulence and volatility of the stock market. He thought he was doing all the right things, but overlooked a very important part of retirement planning. If you are saving money for your retirement, congratulations, you've made a smart choice. Chances are you are also making choices about where to save and invest your money. You've taken advice from what you've learned online, from your friends/family/co-workers, and maybe a Financial Professional... they've all said you need to diversify. But what does that mean? There has been volumes of knowledge about the subject and it seems everybody has a different opinion about what is the "right way". However, lets back away from the "how" and start with simply what diversification is: Putting your hard earned money into different savings and investment vehicles of varying types, ideally to reduce risk. Keep in mind, you may not be eliminating the risk, just reducing it. While there are programs that protect against market volatility, you should understand your own risk tolerance and speak with a Financial Professional about creating a retirement savings program that makes sense for you. In general, diversification is meant to reduce risk. It doesn't guarantee that you'll gain money, and you usually are not protected against market loss. Ok, So how does this work?

However, one of the reasons why may not be what you would think. According to a study by Duke University, sleep-deprived people make risky decisions. "The scientists showed, using a functional MRI, that a night of sleep deprivation leads to increased brain activity in brain regions that assess positive outcomes, while at the same time, this deprivation leads to decreased activation in the brain areas that process negative outcomes. Sleep-deprived individuals in the study tended to make choices that emphasized monetary gain, and were less likely to make choices that reduced loss. While this wasn't true for all of the subjects, the findings are worth heeding."(2) So in other words, when we don't get enough sleep, we're too optimistic about our choices, and ultimately take greater risks that we may not take when we are fully rested. It doesn't stop there though. Jim Gold's insight also outlines the costs of sleep deprivation, "Researchers put the losses from insomnia alone at $63.2 billion annually. About $21 billion was the result of absence from work; the rest from lost productivity on the job.

Increased medical expenses: Insufficient sleep has been linked to the development and management of chronic diseases and conditions, including diabetes, cardiovascular disease, obesity and depression, says the Centers for Disease Control and Prevention.

Caffeine tax: A latte a day, at $3.50 each, will run you $1,277.50 a year."(3) How much money are your habits costing you? Feel free to share and comment below, and lets all make sure that we get a full nights sleep. (1, 3) “How Sleep (or Lack of It) Can Affect Your Bottom Line,” www.moneytalksnews.com, February 5, 2015 (2) "Sleep-Deprived People Make Risky Decisions Based on Too Much Optimism," Duke Medicine News and Communications, March 8, 2011 |

Archives

September 2015

Categories |

RSS Feed

RSS Feed